Comparable to a great financial obligation collector’ while the discussed significantly less than federal rules, real estate loan servicers commonly chosen by the users

Wells Fargo Lender, Letter.An effective., perhaps not within its personal capability but entirely because trustee in the RMAC REMIC Believe, Collection 2010-1

Allonge to note indorsed spend towards order out of Wells Fargo Bank, NA maybe not within the private potential however, entirely due to the fact Trustee for the latest RMAC REMIC Faith, Series 2010-1

In Deutsche Financial Nat

Wells Fargo Financial, N.A., perhaps not in individual capability but solely since Trustee throughout the RMAC REMIC Faith, Collection 20101, by the Rushmore Loan Administration Features, LLC, the designated attorneyin-reality

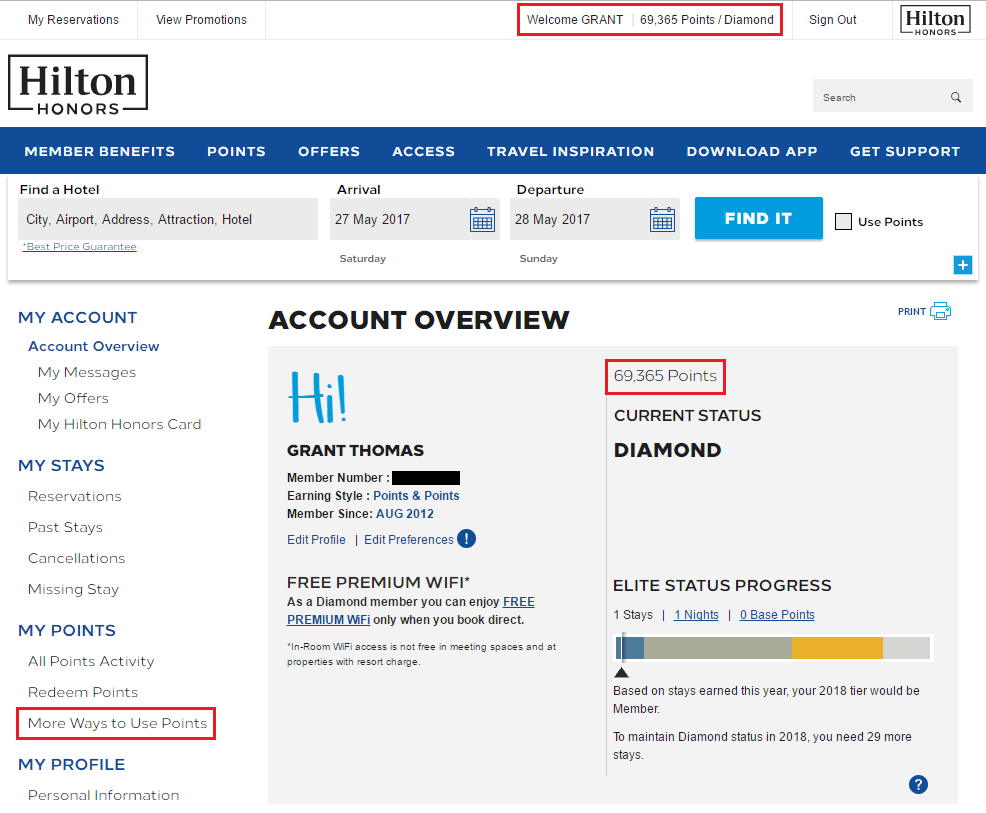

(ECF No. 21 from the cuatro-5.) At exactly the same time, SPS included the latest less than graph summarizing brand new filed assignments of one’s Action out-of Believe:

Wells Fargo Lender, Letter.A beneficial., not in private capability but exclusively as the trustee from the RMAC REMIC Faith, Series 2010-step one

Wells Fargo Bank, N.Good., not in its private skill but only because trustee throughout the RMAC REMIC Trust, Show 2010-1

SPS and you can Rosenberg assert you to definitely Towd Point ‘s the owner of this new Note, and therefore entitled these to collect into Mortgage and institute property foreclosure process, and that Plaintiff’s updates quite the opposite comes from their own misunderstanding away from Maryland legislation. (ECF No. 14-step one at 4; 21 during the 13.) The fresh Grievance alleges that the Notice contains an email Allonge you to definitely reflects an approval out of Wells Fargo Lender, N.A beneficial., in capacity just like the best Trustee to your RMAC and you may REMIC Faith, Show 2010 when you look at the empty. (ECF No. step three, 18i.) SPS and Rosenberg insist he could be eligible to collect and enforce Plaintiff’s Mortgage (for Towd Section) given that Mention comes with a keen indorsement inside the blank; as they are the people during the fingers of the Mention. (ECF Nos. 14-dos from the 5; 21 during the 15.)

Actually, eg trusts are called special purpose vehicles as they just contain the money managed by the trustees and you will accumulated of the financial servicers

Inside evaluating the fresh new parties’ says and objections, the fresh new court discovers it useful to review the new securitization procedure for the loan globe. New securitization process are better-settled inside the

Securitization initiate whenever a home loan originator offers home financing and its mention to help you a buyer, who’s normally a subsidiary away from a good investment bank. New financing financial packages to each other the fresh plethora of mortgages it bought to your a special purpose auto, usually when it comes to a trust, and you can carries the income legal rights some other investors. An effective pooling and you may upkeep arrangement kits a couple organizations you to definitely retain the trust: good trustee, just who protects the borrowed funds property, and a great servicer, just who communicates which have and collects monthly obligations on the mortgagors.

Tr. Co. v. Brock, so it Court made clear you to good special purpose automobile was a business organization that’s solely a data source towards loans; it will not have any staff, organizations, otherwise property except that new funds it orders.’ 430 Md. 714, 718, 63 A good.three-dimensional 40 (2013) (estimating Anderson, 424 Md. in the 237 n. 7). Select in addition to Christopher L. Peterson, Predatory Structured Finance, 28 Cardozo L. Rev. 2185, 2261 (2007) ( Inside a routine purchase, a third party business loans in Elmore is hired in order to provider the loan – meaning

collect your debt. A buyers doesn’t always have the ability to decline to create company that have a family provided servicing rights by a great securitization pooling and you may repair contract.)

New securitization process of the mortgage industry shows you to definitely a count on, including a foreign legal trust, caters to a certain mission about home loan globe. Find Deutsche Lender, 430 Md. on 718. Put differently, the brand new faith entirely constitutes a share out-of financing that eventually feel marketed over to dealers. Look for [Peterson, twenty-eight Cardozo L. Rev.] at 2209. The brand new trustees and you will replace trustees are definitely the stars that carry out and manage this new faith assets. See Anderson, 424 Md. from the 237. The loan servicer, instead of the statutory faith, will act as your debt collector and you can communicates to your consumers. See Peterson, twenty-eight Cardozo L. Rev. within 2261.

Leave a Reply